Quarterly Estimated Taxes: How to Stay Ahead and Avoid Penalties

Peacock & French CPAs

May 01, 2025

If you earn income outside of a traditional W-2 job — whether through freelance work, self-employment, investments, or running a business — you may be required to pay quarterly estimated taxes. Failing to stay ahead can result in costly penalties, not to mention unnecessary stress.

This article breaks down who needs to pay estimated taxes, how to calculate what you owe, and how to plan ahead so you can avoid underpayment surprises — and stay in good standing with the IRS.

What Are Estimated Taxes — and Why Do They Matter?

Simply put, the IRS expects taxpayers to pay taxes on income as it’s earned. For those without automatic withholding (like independent contractors or business owners), that means making tax payments throughout the year — not just at tax time.

Estimated taxes help you:

- Stay compliant with IRS requirements

- Avoid underpayment penalties and interest

- Manage cash flow and reduce financial surprises in April

You may be required to make quarterly estimated payments if you expect to owe at least $1,000 in taxes when you file your return — and your income isn’t subject to withholding. This typically includes:

- Freelancers and Independent Contractors: Especially those working with 1099s.

- Small Business Owners and Sole Proprietors: Regular income without payroll taxes withheld.

- S-Corporation Shareholders: Especially those receiving distributions.

- Real Estate Investors: Rental income or property sales not covered by withholding.

- Gig Economy Workers and Side Hustlers: Platforms like Uber, Etsy, or Airbnb don’t withhold taxes.

- Individuals with Dividend or Capital Gains Income: Investment income may trigger estimated tax obligations.

How to Calculate Your Estimated Payments

There are two primary approaches:

- Safe Harbor Method: Pay 100% of last year’s tax liability (or 110% if your AGI exceeded $150,000).

- Current Year Estimate: Calculate based on your projected income, deductions, and credits.

Here’s a simplified example:

Projected annual income: $100,000

Estimated tax liability: $20,000

Quarterly payments: $5,000 each

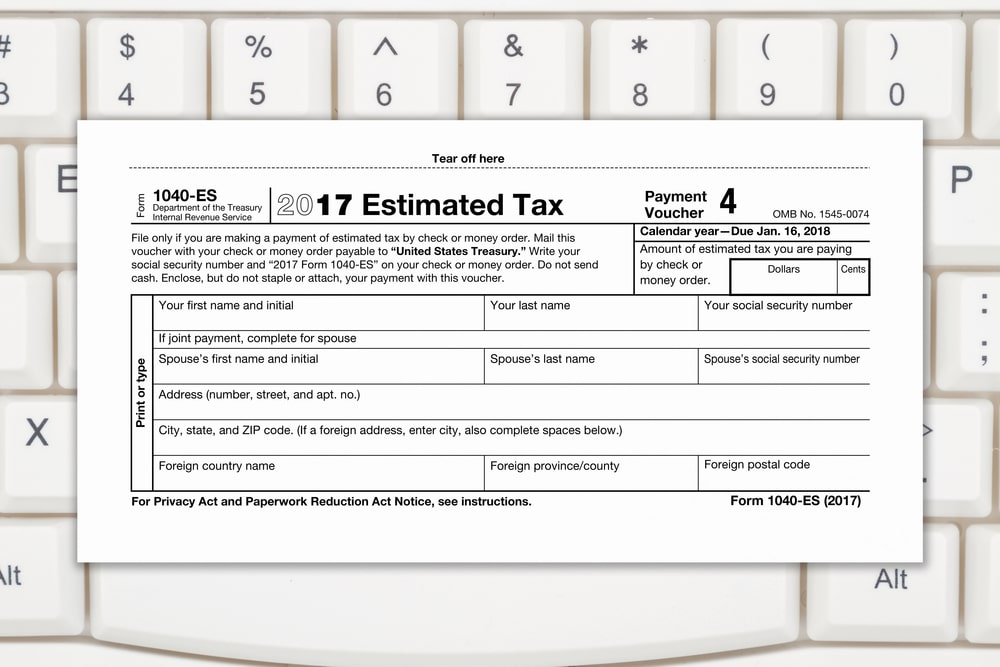

We recommend using IRS Form 1040-ES or consulting with a CPA to ensure accuracy, especially if your income fluctuates.

Okay, I Know What I Owe. How Do I Pay?

Thankfully, the IRS has embraced the 21st century (mostly). You can pay through:

- IRS Direct Pay (simple and free)

- Electronic Federal Tax Payment System (EFTPS)

- Credit/debit card (fees apply)

- Snail mail (just be early)

Pro tip: Set reminders. Automate payments if you can. The fewer things you have to remember during tax season, the better.

Always keep a copy of your confirmation or check number for your records.

What If You Don’t Pay on Time?The IRS doesn’t wait around. Missing or underpaying quarterly payments can trigger:

- Underpayment Penalties

- Interest Charges

- IRS Notices (and nobody wants one of those)

However, in cases of irregular income or unforeseen events, the IRS may grant a penalty waiver. Your CPA can help determine if you qualify and submit the appropriate documentation.

How to Stay on Track (Without the Stress)Here are a few strategies to simplify your quarterly tax process:

- Use Accounting Software: Tools like QuickBooks or Xero provide real-time financial snapshots

- Adjust Payments Each Quarter: If income changes, recalculate your estimated taxes.

- Work With a CPA: Tax professionals can proactively monitor your numbers and avoid costly missteps.

Be Proactive, Not Reactive

Quarterly estimated taxes don’t have to be confusing or overwhelming. With the right guidance and systems in place, you can avoid penalties, stay in control of your finances, and focus on growing your income — not worrying about IRS notices.

Need help calculating, adjusting, or filing your estimated taxes?Venice CPA is here to make it easy. Whether you're managing unpredictable income or running a growing business, we’ll help you plan smart and stay compliant.

>> Contact us today and take the stress out of quarterly tax season.